Lessons learned opening my first Startup

When I opened the company there were so many tasks to organize. If I could go back to the moment I was working on the prioritization, I would make it slightly different.

I would have invested more time in finding new co-founders to work with. The amount of work required to open a Fintech is huge. Having to take care of all areas of the company is hard and even more while searching for funding. After all the road and gas expenses, I learned that having a great team is the best indication that a startup will be a success.

Being a startup founder means you have to work on multiple areas of the company at the same time. Probably more than 12 hours a day 6 days a week. It's challenging, but if you follow a good routine you don't burn out before publishing and trying to find your first customers. My suggestions are: Eat and sleep well, get sunlight, and work out if you can. Meditate for superpowers.

You also want to understand how all the parts of a startup work from the beginning. That way you will not get surprises during the road. I was in shock while creating the valuation to know that marketing would take from 40% to 60% of the total of the loan. Follow an initial structure to start with, try to fill in all the areas and list the responsibilities of each sector:

Startup

- Owners

- Mission

- Values

- Goals

- Product

- Sectors

- Governance

- Design

- Engineering

- Marketing/Sales

- Customer SuccessThe engineering side was great. The stack worked seamlessly, I used Python and Django on the Backend, and Typescript and React-Native for the Frontend. Follow a list of general recommendations:

- Don't create tests at the beginning. The code-base changes too fast and tests make feature delivery run slowly

- Automate the infrastructure and application setup and deployment, it will save you time. Check out my post about about it.

- On the Frontend side, using Expo helped increase the setup, review, and deployment of the app!

- Building the subscription payment module is more complex than it seems, it took me long nights hacking to understand how it fully works

- It will take at least a year to build a fully functional app published in the stores working alone. Don't make the mistake of thinking that it's fast.

- Apple takes rigorous security levels while publishing an app to their Store. Even more for fintech that uses user's bank accounts information. So you have to open a company and follow their guidelines. PlayStore is easier and quicker to publish, I loved it!

When to raise funding? As soon as you can! Prioritize building a beta version of your app and launch it as soon as possible. This allows customers to engage early, providing valuable feedback that can help you refine and enhance the product quickly. Once your company is achieving at least 5% customer growth per week, it's a strong signal that your company may be ready to pursue fundraising.

YCombinator offers guidelines on how to get funding and create your valuation. I recommend reading and watching all YouTube videos if you want to learn more about the challenges that you will face while asking for money.

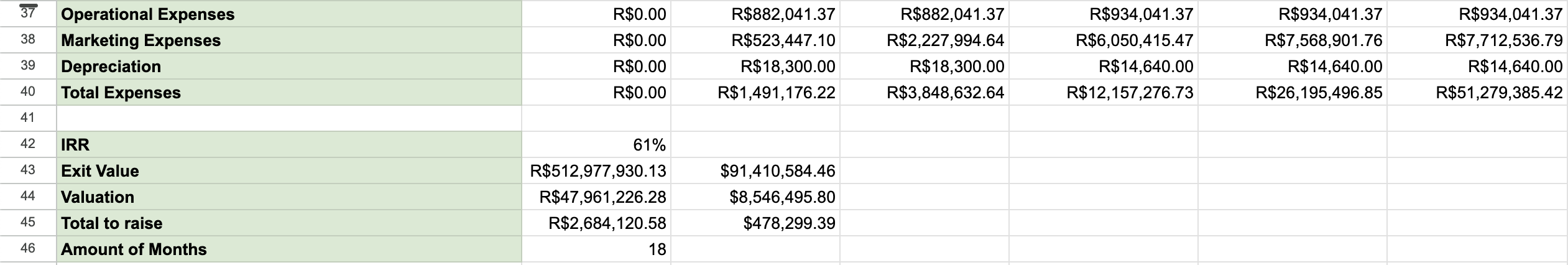

The Valuation is calculated based on all the income and expenses of the company during the next 5 years. This includes salaries, equipment, marketing expenses, and more! The main goal of the Valuation is to calculate the Exit Value and IRR, investors will want these and some other metrics from the valuation. Follow an example (some values are not right):

It was a great adventure opening my first Startup! So many lessons learned. I believe it was worth all nights without sleeping, the stress, the fear of running out of money, and even not getting my first funding. It all made me a stronger person. Now I understand better what is required to open a successful startup.